Directors and Officers Liability Policy

Protects leaders from legal claims arising from their decisions and actions.

Directors and Officers Liability Insurance (D&O) is essential for protecting corporate leaders from personal financial loss due to lawsuits stemming from their decision-making. This policy covers claims of wrongful acts, errors, or omissions in their corporate roles, safeguarding them against litigation from shareholders, regulators, or other stakeholders.

Key Benefits

- Protection from legal claims against directors and officers.

- Covers misstatements, errors, neglect, and violations of duty.

- Shield against financial loss due to lawsuits or regulatory actions.

- Supports executives in performing their corporate duties without fear of personal liability.

Enquiry Now

What is Directors and Officers Liability Policy?

Directors and Officers Liability Insurance (D&O) protects individuals in leadership positions against claims arising from wrongful acts, such as mismanagement, negligence, or breach of duty. It helps shield directors, officers, and key executives from financial loss due to allegations related to their decision-making.

What is Directors and Officers Liability Policy?

Directors and Officers insurance protects directors and officers by covering defense costs, settlements, judgments, and other related expenses arising from claims made against them.

Why do you need Directors and Officers Liability Policy?

Protect Personal Assets

Safeguard your personal wealth against legal claims.

Manage Legal Risks

Cover the costs of defending against lawsuits and claims.

Attract Top Talent

Offer security and confidence to potential directors and officers.

Ensure Corporate Governance

Support sound decision-making and protect against managerial errors.

Why choose Insurance Manager to protect your business?

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

What does Directors and Officers Liability Policy

cover and exclude?

Plan Coverage

Advancement of Defense Costs

Insurer pays legal defense expenses as they are incurred.

Claims-Made Principle

Coverage applies only to claims made during the policy period.

Right to Defend

Directors and officers retain the right to defend themselves in court.

Coverage for Subsidiaries

Entities with over 50% ownership or board control are covered.

Outside Directorship Coverage

Extends protection to directors serving on external boards.

Cover for Retired Directors

Protection continues for up to 6–7 years after leaving the company.

Employment Practices Liability (EPL)

Covers claims of wrongful termination, harassment, or discrimination.

Professional Negligence

Protects against supervisory errors or breaches of duty.

Major Exclusions

Fraudulent Acts

No coverage for deliberate fraud or dishonest conduct.

Criminal Violations

Claims arising from criminal behavior are excluded.

Willful Breach of Law

Knowing or intentional violation of the law is not covered.

Prior Known Claims

Pre-existing or known legal disputes are excluded.

Fines & Penalties

Statutory fines or punitive damages are not reimbursed.

Bodily Injury & Property Damage

Physical injury or property loss is generally excluded.

War or Terrorism

Losses from acts of war or terrorism may be excluded unless added.

Emergency Costs Not Pre-Approved

Emergency legal or defense costs may be excluded if not reported or pre-approved by the insurer.

Plan Coverage

Protecting Directors & Officers from Personal Liability

Coverage for actions taken in good faith while fulfilling company duties.

Protection Against Wrongful Acts

Indemnity for claims arising from misjudgments made in an official role.

Legal Costs Protection for Directors & Officers

Coverage for legal expenses in criminal or civil proceedings with insurer approval.

Coverage for Shareholder Legal Expenses

Protection against costs incurred by shareholders in a claim against directors/officers.

Indemnity for Directors in Case of Insolvency

Ensures coverage for the estate or legal representatives of an insolvent director/officer.

Shielding Directors Against Corporate Claims

Defense against legal actions taken against directors in their official duties.

Protection Against Costly Investigations & Inquiries

Coverage for attendance and legal defense during regulatory investigations and proceedings.

Safeguarding Legal Representatives & Heirs

Protection extends to the estate or heirs of a director or officer in case of financial distress.

- In-patient treatment 24 hours a day

- Pre-existing disease

- Pre and Post hospitalization

- Domiciliary hospitalization expenses

- Reimbursement of cost of health check-up

- All day care procedure

- Family floater to covers member’s immediate family such as a spouse, dependent children, dependent parents, etc.

- Maternity benefits

- Dental treatment

- Cost of spectacles, contact lenses

- Waiver of waiting period

- Waiver of first-year exclusions

- Reimbursement of ambulance costs

- Baby day one care

- Vaccination benefits

- Increased room rent limits

- Corporate buffer

- Out-patient treatment (OPD Card)

- Root canal surgery

- In-hospitalization expenses due to sickness or accidents

- Room and boarding expenses as provided by the hospital/nursing home.

- Nursing expenses.

- Surgeon, anesthetist, medical practitioner, consultants or specialist fees.

- Anesthesia, blood, oxygen, operation theatre charges, surgical appliances, medicines and drugs, diagnostic materials and X-Ray, dialysis or chemotherapy.

Major Exclusions

Exclusion of Prior and Pending Litigation

Claims or litigation submitted under previous policies are not covered.

Exclusion of Bodily Injury and Property Damage

Does not cover bodily harm, emotional distress, or destruction of tangible property.

Exclusion of Insured v/s Insured Claims

Directors suing each other are excluded from coverage under the policy.

Exclusion of Illegal Personal Profits

Does not cover claims arising from illegal personal gain or remuneration.

Exclusion of Fraudulent or Dishonest Acts

Coverage excludes deliberate, dishonest, or fraudulent behavior by directors/officers.

Exclusion of Pollution and Contamination

Claims related to pollution or environmental contamination are excluded.

Exclusion of Insider Trading

The policy does not cover any claims arising from insider trading activities.

Exclusion of Emotional Distress and Death

Claims related to emotional distress or death are not covered under this policy.

- If the appropriate waiver is not opted for, then the policy will not cover

- Treatment of pre-existing illnesses.

- Any treatment for illnesses/diseases within the first 30 days of the policy, unless it is an accident.

- Treatment of specified illnesses for the first year of the policy.

- Certain diseases like hernia, cataract, piles, sinusitis, etc are excluded during the first year of operation in the cover.

- Any claim arising out of or traceable to pregnancy.

- Ayurvedic, homeopathy, naturopathy or any other form of local medication.

- Alcoholism, drug abuse, and AIDS.

- Dental treatment or surgery unless it requires hospitalization.

- Cost of spectacles.

- Vaccination and inoculation.

- Cosmetic treatment.

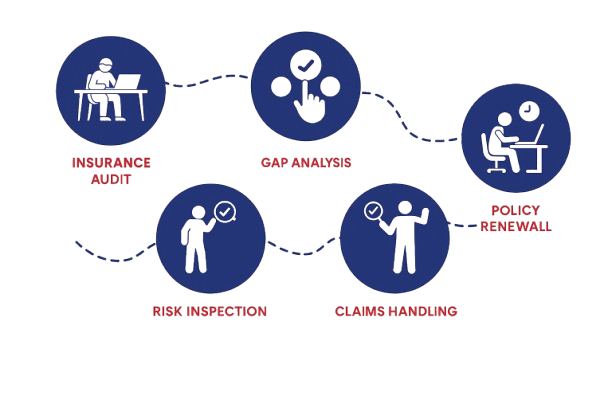

Your Journey to Insurance Manager

When can I Claim?

A claim under Directors and Officers Liability Policy can be registered in the below circumstances:

- If a director or officer faces a lawsuit for alleged misconduct or negligence

- When claims are made by third parties such as shareholders, employees, or regulators

- If legal defense costs arise from allegations related to corporate decisions

Claim what’s yours with Insurance Manager

Have more questions?

Submission

Assessment