Cyber Liability

Protecting Your Business from Digital Risks and Threats

In today’s tech-driven world, companies face significant risks related to cyber threats, from data breaches to cybercrime. Cyber Liability Insurance helps safeguard businesses from the financial impact of these risks by covering losses related to the use of computer systems, networks, and the internet. With many traditional policies inadequate for these threats, Cyber Liability provides comprehensive protection for data loss, privacy issues, and cyber-related liabilities, ensuring businesses stay secure in an increasingly digital landscape.

Cyber Liability Insurance protects businesses from financial losses due to cyber-attacks, data breaches, and digital threats. With over 375 attacks occurring daily in India, the risk to businesses is significant. High-profile breaches like BigBasket and Dunzo have exposed millions of users’ data. This insurance covers both first-party losses (e.g., e-theft, reward expenses) and third-party liabilities (e.g., legal claims). It ensures compliance with the Personal Data Protection Bill, which enforces strict data security rules. Penalties for violations can reach up to ₹250 crore. The policy helps businesses manage legal, financial, and reputational risks. It includes support for defense costs and breach response. Coverage is vital for any company handling digital data. Cyber insurance is no longer optional—it’s a necessity.

Key Benefits

- We cover expenses incurred in forensic services to identify the first breach.

- Covers expenses related to data privacy laws and regulations.

- Helps mitigate the costs of data loss, system failures, and cybercrimes.

- Ensures business continuity in the event of a cyber attack or data breach.

- Protects your brand and public image following a cyber incident.

Enquiry Now

What is Cyber Liability?

Cyber liability insurance is designed to protect businesses from financial losses caused by cyber-attacks, data breaches, and other digital risks. As businesses increasingly rely on digital systems, the risk of cyber incidents grows, making this type of insurance essential.

Why do you need Cyber Liability?

Financial Security

Minimize the financial impact of cyber-attacks and losses.

Data Breach Protection

Safeguard your business against costly data breaches.

Legal and Regulatory Compliance

Ensure compliance with data privacy laws and avoid penalties.

Reputation Management

Protect your business's reputation after a cyber event.

Why choose Insurance Manager to protect your business?

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

What does Cyber Liability cover and exclude?

Plan Coverage

Forensic Costs

Expenses incurred in forensic services to identify the first breach.

E-theft Loss

Protection from financial loss due to fraudulent online transactions.

E-communication Loss

Covers fraudulent communications that trick clients into transferring funds.

Extended Reporting Period

Allows late reporting of breaches occurring during the policy term.

Defense Cost

Legal fees covered for alleged privacy breach.

First-Party Loss

Covers direct losses viz Ransomware demands, Business interruption and Data recovery costs

Third-Party Liability

Covers legal claims from affected customers, vendors, or partners.

Breach Notification Costs

Covers expenses to notify affected individuals and regulators.

Major Exclusions

Physical Property Damage

Tangible asset damages (e.g., office hardware) are not covered.

Intentional Acts

Any willful or fraudulent acts by the insured are excluded.

Prior Known Issues

Claims related to events knowingly disclosed before policy start are not covered.

Employee Fraud

Internal fraud or misconduct by staff is typically excluded.

Intellectual Property Theft

Loss of third-party IP is not covered unless specified.

Consequential Business Loss

Losses like reputational damage, lost contracts, or future business opportunities are excluded.

Credit Risk or Loan Default

Financial defaults caused by cyber events are not insurable.

Post-Incident Delayed Claims

Losses reported long after being known may be excluded.

Plan Coverage

Denial of Service Attacks

Protects against attacks that prevent unauthorized access to websites or systems.

Unauthorized Data Access

Covers losses due to unauthorized access, use, or tampering with data.

Data Privacy Breaches

Protects against the disclosure of confidential information or privacy invasion.

Malicious or Accidental Data Loss

Covers losses from the malicious or accidental loss of digital assets or data.

Malware and Viruses

Includes protection from the introduction of harmful code, malware, or viruses.

Cyber Extortion

Covers financial losses related to cyber extortion or terrorism threats.

Reputation Damage

Includes coverage for personal media injury such as defamation or libel from electronic content.

Crisis Management Expenses

Covers costs related to crisis management, public relations, and restoring data or systems.

- In-patient treatment 24 hours a day

- Pre-existing disease

- Pre and Post hospitalization

- Domiciliary hospitalization expenses

- Reimbursement of cost of health check-up

- All day care procedure

- Family floater to covers member’s immediate family such as a spouse, dependent children, dependent parents, etc.

- Maternity benefits

- Dental treatment

- Cost of spectacles, contact lenses

- Waiver of waiting period

- Waiver of first-year exclusions

- Reimbursement of ambulance costs

- Baby day one care

- Vaccination benefits

- Increased room rent limits

- Corporate buffer

- Out-patient treatment (OPD Card)

- Root canal surgery

- In-hospitalization expenses due to sickness or accidents

- Room and boarding expenses as provided by the hospital/nursing home.

- Nursing expenses.

- Surgeon, anesthetist, medical practitioner, consultants or specialist fees.

- Anesthesia, blood, oxygen, operation theatre charges, surgical appliances, medicines and drugs, diagnostic materials and X-Ray, dialysis or chemotherapy.

Major Exclusions

Physical Property Damage

Excludes coverage for physical property damage unrelated to cyber risks.

Intentional Acts

Does not cover losses resulting from intentional, criminal acts by employees or management.

Prior Known Issues

Excludes coverage for breaches or issues known before the policy period began.

Employee Fraud

Does not cover losses related to employee fraud or theft that are not cyber-related.

Intellectual Property Infringement

Excludes coverage for intellectual property infringement or misappropriation.

General Liability

Excludes general liability claims that are unrelated to cyber activities.

Government Fines

Does not cover government penalties or fines related to violations of regulations.

Unsolicited Communication

Excludes losses from unsolicited communications, including spam and phishing attacks.

- If the appropriate waiver is not opted for, then the policy will not cover

- Treatment of pre-existing illnesses.

- Any treatment for illnesses/diseases within the first 30 days of the policy, unless it is an accident.

- Treatment of specified illnesses for the first year of the policy.

- Certain diseases like hernia, cataract, piles, sinusitis, etc are excluded during the first year of operation in the cover.

- Any claim arising out of or traceable to pregnancy.

- Ayurvedic, homeopathy, naturopathy or any other form of local medication.

- Alcoholism, drug abuse, and AIDS.

- Dental treatment or surgery unless it requires hospitalization.

- Cost of spectacles.

- Vaccination and inoculation.

- Cosmetic treatment.

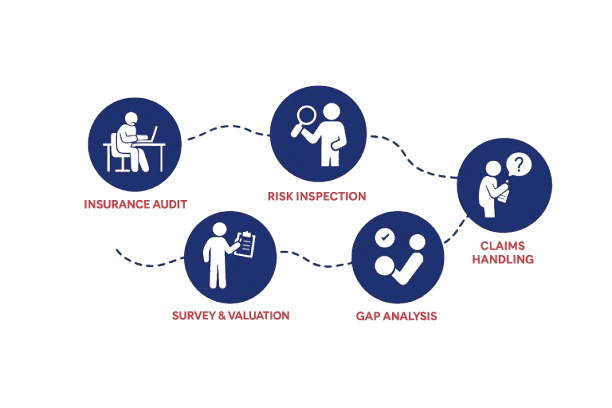

Claims Process and Risk Management

When can I Claim?

A claim under Cyber Liability can be registered in the below circumstances:

- Data Breach: When client data is exposed or stolen due to a cyber attack or security vulnerability.

- System Failure: If your business experiences a network failure that leads to financial loss or operational downtime.

- Privacy Violations: When your company is found non-compliant with privacy regulations or laws governing data protection.

Claim what’s yours with Insurance Manager

Have more questions?

Submission

Assessment