Commercial General Liability Policy

Comprehensive Protection for Business Operations and Public Liabilities

A Commercial General Liability (CGL) Insurance Policy offers vital protection for businesses against potential lawsuits and claims involving bodily injury, property damage, and personal injury. Whether caused by accidents on your premises or defects in your products, a CGL policy shields your business from financial and legal risks, providing peace of mind while you focus on your operations.

Key Benefits

- Protection against third-party bodily injury claims

- Coverage for property damage caused by your business activities

- Legal defense costs for liability-related claims

- Coverage for product-related accidents or defects

- Ensures business continuity with financial security

Enquiry Now

What is Commercial General Liability Policy?

CGL insurance provides businesses with coverage for legal liabilities that arise from third-party claims related to bodily injury, property damage, personal injury, and advertising injuries. It is a crucial policy for protecting businesses from lawsuits and legal costs due to accidents or injuries involving the public or clients.

Why do you need Commercial General Liability Policy?

Protects Against Lawsuits

Coverage for legal defense costs and settlement claims.

Safeguards Your Business Assets

Prevents financial strain from unexpected liability claims.

Covers Third-Party Injuries & Damages

Compensation for bodily injuries or property damage caused to others.

Ensures Business Continuity

Ensures smooth business operations without legal disruptions.

Why choose Insurance Manager to protect your business?

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

What does Commercial General Liability Policy cover and exclude?

Plan Coverage

General Liability Coverage

Protects against bodily injury or property damage on and off your premises.

Product Liability & Completed Operations

Covers defects in your products and completed operations, such as machinery or designs handed over to clients.

Personal & Advertising Injury

Covers reputation damage from libel, slander, or advertising-related injuries.

Medical Expenses

Covers medical care for accidental injuries on your premises, regardless of fault.

Bodily Injury on Premises

Protection against third-party injuries occurring on your business property.

Property Damage

Coverage for damage to third-party property caused by your business activities.

Legal Defense Costs

Pays for legal defense costs incurred in claims related to bodily injury, property damage, or personal injury.

Completed Products Liability

Covers liability for damages caused by completed products after delivery or installation.

- In-patient treatment 24 hours a day

- Pre-existing disease

- Pre and Post hospitalization

- Domiciliary hospitalization expenses

- Reimbursement of cost of health check-up

- All day care procedure

- Family floater to covers member’s immediate family such as a spouse, dependent children, dependent parents, etc.

- Maternity benefits

- Dental treatment

- Cost of spectacles, contact lenses

- Waiver of waiting period

- Waiver of first-year exclusions

- Reimbursement of ambulance costs

- Baby day one care

- Vaccination benefits

- Increased room rent limits

- Corporate buffer

- Out-patient treatment (OPD Card)

- Root canal surgery

- In-hospitalization expenses due to sickness or accidents

- Room and boarding expenses as provided by the hospital/nursing home.

- Nursing expenses.

- Surgeon, anesthetist, medical practitioner, consultants or specialist fees.

- Anesthesia, blood, oxygen, operation theatre charges, surgical appliances, medicines and drugs, diagnostic materials and X-Ray, dialysis or chemotherapy.

Major Exclusions

Expected or Intended Injury

Excludes coverage for injuries or damages that are expected or intentional.

Contractual Liability

Excludes liability arising from contractual agreements, obligations, or warranties.

Worker’s Compensation and Similar Laws

Does not cover employee injuries or claims related to worker's compensation laws.

Pollution

Excludes liability for pollution-related damages, cleanup costs, or remediation.

Damage to Your Property, Product, or Work

Excludes damage to your own property, products, work, materials, or equipment.

Aircraft, Auto, or Watercraft

Excludes coverage for incidents involving aircraft, vehicles, or watercraft.

Professional Liability

Excludes claims related to professional advice or services provided by your business.

Electronic Data

Does not cover liability arising from electronic data breaches or cyber incidents.

- If the appropriate waiver is not opted for, then the policy will not cover

- Treatment of pre-existing illnesses.

- Any treatment for illnesses/diseases within the first 30 days of the policy, unless it is an accident.

- Treatment of specified illnesses for the first year of the policy.

- Certain diseases like hernia, cataract, piles, sinusitis, etc are excluded during the first year of operation in the cover.

- Any claim arising out of or traceable to pregnancy.

- Ayurvedic, homeopathy, naturopathy or any other form of local medication.

- Alcoholism, drug abuse, and AIDS.

- Dental treatment or surgery unless it requires hospitalization.

- Cost of spectacles.

- Vaccination and inoculation.

- Cosmetic treatment.

Plan Coverage

Bodily Injury & Property Damage Liability

Protects against legal liabilities for injuries or property damage to third parties.

Personal and Advertising Injury Liability

Covers non-physical injuries such as defamation, copyright infringement, and misleading advertisements arising from your business communication or marketing activities.

Medical Payments

Covers medical expenses for accidental injuries on business premises or during operations.

Products and Completed Operations Liability

Protects your business against claims that arise after a product has been sold or a service has been completed, especially if they result in injury or property damage.

Public Liability Coverage

Covers third-party injury or damage claims from your premises or public business activities, including legal costs.

Product Liability Coverage

Covers injury or damage caused by your products, including recall expenses when applicable.

Fire Damage Legal Liability

Offers protection against fire damage to property you rent or occupy, caused by negligence during your tenancy.

Extended Coverage Options

Includes optional add-ons like pollution, auto, terrorism, valet, and custody liability coverages.

Major Exclusions

Product Guarantee and Replacement Costs

Excludes any expenses related to fixing or replacing products that fail to perform as expected but have not caused injury or damage.

Financial Losses or Lost Profits

Does not provide compensation for purely financial losses, missed opportunities, or revenue declines not linked to injury or property damage.

Errors and Omissions

Excludes liabilities arising from failure to perform professional duties or incorrect advice given by the business.

Fraudulent or Dishonest Acts

Claims resulting from deliberate, dishonest, or illegal actions committed by you or your employees are not covered under this policy.

Products Manufactured in the USA or Canada

Policies typically exclude claims related to products made, sold, or distributed in the United States or Canada due to jurisdictional risks.

Product Inefficacy

Coverage does not apply if a product fails to function as intended without causing any injury or damage.

Damage to Owned or Controlled Property

Excludes coverage for property that is owned, rented, or controlled by your business, including business premises or equipment.

Aircraft, Automobiles, and Watercraft (Owned)

Liability arising from the ownership or use of aircraft, company-owned automobiles, or watercraft is not included under this policy.

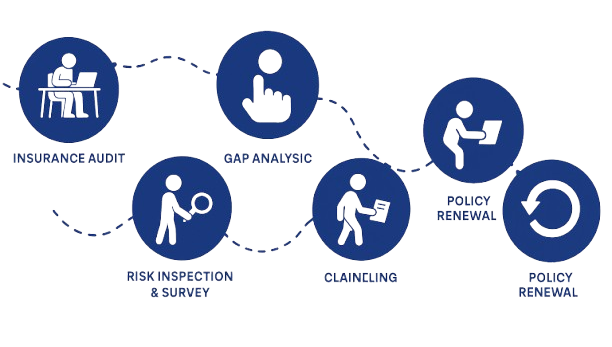

Claims Process and Risk Management

When can I Claim?

A claim under Commercial General Liability Policy can be registered in the below circumstances:

- Bodily Injury on Premises: Claims for injuries sustained by third parties on your business property.

- Property Damage by Business Activities: Claims for damage to third-party property caused by your business.

- Product Liability Claims: Claims arising from defects or malfunctions in products you sell or manufacture.

Claim what’s yours with Insurance Manager

Have more questions?

Submission

Assessment