Workmen Compensation

Protect all your employees from medical emergencies

Key Benefits

- Accidental Death & Disability Cover

- Permanent Partial Disability

- Weekly Compensation Cover

- Accidental Medical Expenses

- Compensation Amount Related to Salary

- Occupational Diseases

- Unnamed Policy (Workers)

Legally Covers

- Workmen Compensation Act 1923

- The Fatal Accidents Act, 1855

- Duty at Common Law

Enquiry Now

What is Workmen Compensation?

The Workmen’s Compensation Insurance Policy provides for legal liability coverage for compensation to your employees for bodily injury or death caused due to accidents/occupational diseases arising out of and in the course of employment.

Why do you need Workmen Compensation?

Protect Your Workforce

Comprehensive protection for your employees against workplace risks.

Compliance Made Easy

Ensure legal and financial safety with a robust compensation plan.

Emergency Support Assurance

Be prepared to meet medical and financial obligations effectively.

Safety and Security First

Strengthen your employer-employee bond with reliable compensation.

Why choose Insurance Manager to protect your business?

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Comprehensive Protection for Your Workforce

Ensure employee well-being with complete health insurance coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Cost-Effective Group Insurance Plans

Affordable plans with benefits like maternity, critical illness, and dependent coverage.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Peace of Mind for Employers and Employees

Reduce financial stress with cashless claims and reimbursement options.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

Boost Employee Productivity and Retention

Build loyalty and motivation by easing economic and mental burdens.

What does Workmen Compensation cover and exclude?

Plan Coverage

Medical Expenses

Coverage for Treatment of Work-Related Injuries

Disability Compensation

Support for Temporary or Permanent Disability

Death Benefits

Financial Aid for Family in Case of Employee Death

Rehabilitation Costs

Support for Physical or Occupational Rehabilitation

Loss of Earnings

Compensation for Income Loss Due to Injury

Legal Expenses

Coverage for Legal Fees in Claims Cases

Accidents During Work Activities

Protection for Work-Related Accidents Offsite

Occupational Diseases

Coverage for Diseases from Work-Related Exposure

- In-patient treatment 24 hours a day

- Pre-existing disease

- Pre and Post hospitalization

- Domiciliary hospitalization expenses

- Reimbursement of cost of health check-up

- All day care procedure

- Family floater to covers member’s immediate family such as a spouse, dependent children, dependent parents, etc.

- Maternity benefits

- Dental treatment

- Cost of spectacles, contact lenses

- Waiver of waiting period

- Waiver of first-year exclusions

- Reimbursement of ambulance costs

- Baby day one care

- Vaccination benefits

- Increased room rent limits

- Corporate buffer

- Out-patient treatment (OPD Card)

- Root canal surgery

- In-hospitalization expenses due to sickness or accidents

- Room and boarding expenses as provided by the hospital/nursing home.

- Nursing expenses.

- Surgeon, anesthetist, medical practitioner, consultants or specialist fees.

- Anesthesia, blood, oxygen, operation theatre charges, surgical appliances, medicines and drugs, diagnostic materials and X-Ray, dialysis or chemotherapy.

Major Exclusions

Exclusions in Workmen Compensation Insurance

A Comprehensive Overview of Non-Covered Scenarios

Pre-Existing Illnesses & Coverage

Affecting Insurance Claims

Initial Policy Period: Limitations on Illness Treatment

What Is Not Covered Within the First 30 Days of the Policy

First Year Illness Exclusions

Key Diseases Not Covered in Initial Policy Year

Pregnancy-Related Claims & Workmen Compensation

Understanding the Exclusion of Pregnancy in Compensation Policies

Non-Conventional Treatments Exclusion

Ayurveda, Homeopathy, and Naturopathy Not Covered

Substance Abuse & AIDS Exclusions

How Substance Abuse and HIV-Related Claims Are Not Covered

Cosmetic Surgery Exclusion

Non-Medical Treatments Not Covered

- If the appropriate waiver is not opted for, then the policy will not cover

- Treatment of pre-existing illnesses.

- Any treatment for illnesses/diseases within the first 30 days of the policy, unless it is an accident.

- Treatment of specified illnesses for the first year of the policy.

- Certain diseases like hernia, cataract, piles, sinusitis, etc are excluded during the first year of operation in the cover.

- Any claim arising out of or traceable to pregnancy.

- Ayurvedic, homeopathy, naturopathy or any other form of local medication.

- Alcoholism, drug abuse, and AIDS.

- Dental treatment or surgery unless it requires hospitalization.

- Cost of spectacles.

- Vaccination and inoculation.

- Cosmetic treatment.

Scope of Coverage

Accidental Death (PA Death)

Coverage for the death of an employee as a result of a workplace injury. The employee's dependents receive compensation.

Permanent Total Disability (PTD)

If an employee is permanently disabled and cannot work again, compensation is provided to cover the loss of future income.

Permanent Partial Disablement (PPD)

If an employee becomes partially disabled but can still perform some tasks, they are compensated for the reduced capacity.

Temporary Total Disablement (TTD)

Provides compensation for employees who are temporarily unable to work due to injury but will return to full capacity after recovery.

Temporary Partial Disablement (TPD)

Provides compensation for employees who return to work but cannot do so at full capacity due to partial disability.

Major Exclusions

Non-fatal Injuries

Injuries that do not result in death are typically not covered under this insurance policy.

Substance Abuse

Injuries occurring while an employee is under the influence of alcohol or drugs are excluded.

Contractor Employees

Claims made by employees of independent contractors (not directly employed by the policyholder) are excluded.

Policy Amendments

Changes made to the policy after it is activated are generally not covered.

Add-ons Provided under Workmen Compensation Policy

Sub-contractor Cover

If a contractor hires a sub-contractor without WC coverage, the contractor can add this specific coverage to ensure the sub-contractor's employees are covered under WC.

Medical Extension

This add-on extends medical coverage for workers who are hospitalized for more than 24 hours due to an injury or illness incurred at work.

Terrorism

A specialized add-on covering losses caused by terrorist attacks, extending the WC coverage beyond conventional accidents.

Occupational Disease

Covers illnesses caused by the workplace environment, including conditions like Compressed Air Disease from high or low-pressure areas such as tunnels or underwater sites.

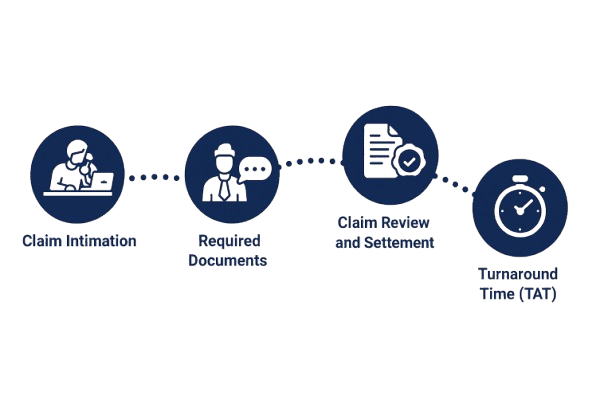

Your Journey to Insurance Manager

Claims Process

Employer's Liability (EL)

- EL Insurance : This covers the employer's liability in case an employee files a claim under the Workers' Compensation Act. Employers are legally required to ensure that their workers are protected, and this policy is designed to manage that liability.

- Claims for Employees : Employees earning different salary levels (e.g., ₹4,000, ₹8,000, ₹15,000) can file claims under this policy in case of injury or death.

Claim what’s yours with Insurance Manager

Have more questions?

Submission

Assessment

Resolution

When can I Claim?

A claim under Workmen Compensation can be registered in the below circumstances:

- Employee Death: Claim for accidents or occupational hazards causing death.

- Workplace Injuries: Covers medical costs and lost wages for on-duty injuries.

- Occupational Diseases: Claims for illnesses caused by work conditions.

Frequently Asked Questions (FAQ)

• Group Personal Accident (GPA): Covers employees in case of accidents, but doesn’t typically cover occupational diseases.

• Employee State Insurance Corporation (ESIC): A social security scheme offering medical and other benefits to employees, typically for larger establishments.

• Incomplete or late document submission

• Disputes on claim eligibility

These can lead to claim rejection or delayed settlements.